December 2020 marks the closing of an unprecedented and unpredictable year. Despite the global pandemic, competition for residential real estate is still as heated as ever in Toronto and the wider Ontario markets. Today we decided to have a look at Ontario’s different real estate markets and see how 2020 fared amidst a tumultuous and challenging year.

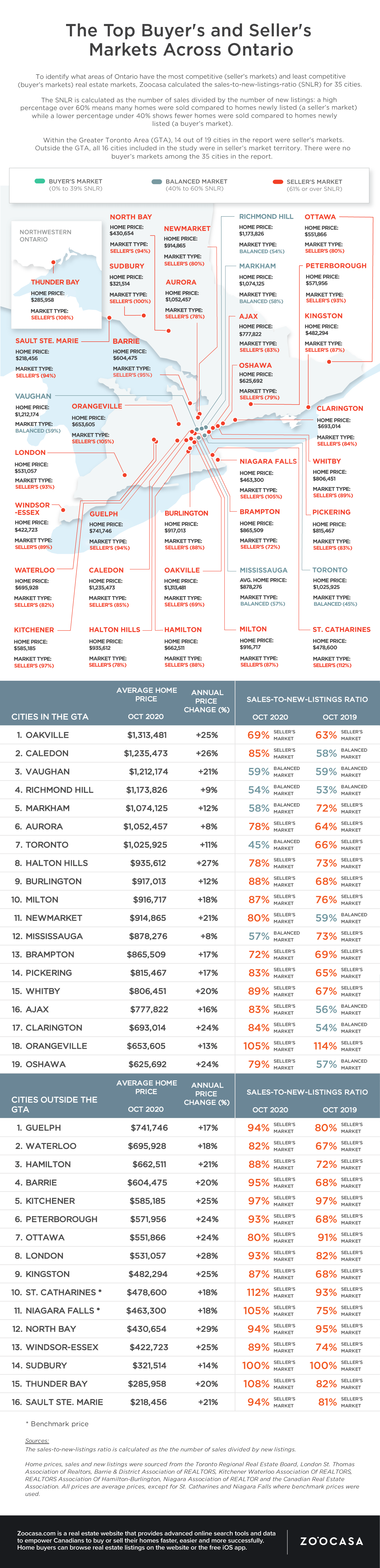

Overall, supply was still significantly low this year in relation to demand across Ontario but there was a significant uptick in sales as well. As with a lower supply and high demand, competition was markedly more competitive than previous years. To assess the housing competition across the different markets in Ontario, we look at a region’s sales-to-new-listings-ratio (SNLR) which is calculated by dividing the total number of sales by the number of new listings at a point in time. It is meant to illustrate the demand and supply dynamics and assess the competition that buyers face in relation to supply. If the SNLR is under 40%, the market is considered to be in the buyers’ favour with more new listings than sales. If the SNLR is above 40% but below 60%, the market is considered balanced with a relatively even number of new listings and sales. And if the SNLR is above 60%, the market is considered a seller’s market with more sales than new listings.

Of 35 real estate boards across Ontario, 30 markets were sellers’ markets with SNLR scores above 60% for the month of October. By comparison, last year in October 2019, only 27 markets were considered competitive for buyers. In fact, many real estate boards reported that October 2020 marked a record-breaking month of sales.

Of the 19 housing markets in the GTA, 14 had a high SNLR indicating a seller’s market. That’s almost 75% of the GTA. The remaining 5 exhibited balanced competition conditions. The Toronto, Markham and MIssissauga markets were part of the balanced markets though last year they were all highly competitive for buyers. Markets such as Oshawa, Ajax and Clarington all displayed a high SNLR this year in comparison to their balanced scores last year. It is important to note that many of the figures this year have been influenced by the fluctuations in the condo market in which sales have drastically declined during the pandemic and new listings have increased by a huge margin in comparison to last year. This would explain why the Toronto and Mississauga markets display balanced conditions as they are condo-dense markets. Freehold homes continue to be highly sought after which is predicted to continue into 2021.

By comparison, outside of the GTA, all of the housing markets are sellers’ markets meaning buyers face a high amount of competition. Though this isn’t new looking at the previous year’s SNLR scores, 4 of the markets displayed an SNLR at or over 100%. Sudbury, Thunder Bay, St Catherines and Niagara Falls all scored incredibly high meaning buyers face incredibly stiff competition for housing in those markets.

There is still much uncertainty in the markets across Ontario while the pandemic continues to ravage the world. It’s difficult to predict for certain but it does seem like many of Ontario’s housing markets will remain competitive, particularly if they have a majority of freehold homes as opposed to condos. Buyers will likely continue to see higher prices and high competition as supply continues to remain low.

Infographic courtesy of Zoocasa